Introduction

Imagine this: It’s the end of the month. Employees are excited for their salaries. But… a few get the wrong amounts. Some don’t get paid at all. HR scrambles to fix things. Morale drops. You now have to spend hours correcting mistakes that could have been prevented.

Payroll is one of the most sensitive and error-prone processes in HR. Even small mistakes can lead to big headaches—like employee frustration, compliance issues, or even government penalties.

But here’s the good news: Most payroll errors are preventable—especially when you use Udyamo HRMS. Let’s explore how.

How Payroll Errors Happen—And Why They’re More Common Than You Think

“Why did I get less salary this month?”

“There’s a deduction I don’t recognize.”

“My contractor just got taxed like a full-time employee!”

Payroll errors don’t always come from carelessness. They often stem from outdated processes, overworked HR teams, and systems that don’t communicate with each other.

1. Misclassification: A Silent Payroll Risk

You onboard a freelance designer to help with a short-term project. A month later, they appear on the payroll as a full-time employee—with PF and tax deductions applied. Nobody caught it because the data was entered once and never validated. The HRMS didn’t prompt a check.

Now you’re correcting tax filings, refunding over-deducted amounts, and possibly violating labor regulations.

Why this happens: Companies often lack rule-based logic to distinguish contractors, interns, and employees. Without guardrails, roles blur—and so does compliance.

2. When Manual Entry Becomes a Minefield

It’s 9 p.m. on the last day to run payroll. You’re scrolling through Excel rows, updating hours worked and reimbursement claims. One wrong cell. One shifted decimal. And just like that, someone gets ₹85,000 instead of ₹58,000.

Why this happens: Manual processes are prone to fatigue-driven errors. They work until they don’t—and when they fail, they fail loudly.

3. Statutory Changes No One Noticed

The professional tax slab changed this quarter. But you didn’t catch the notification. Your payroll system wasn’t connected to government updates. So the same old rate was applied.

Three months later, a government notice arrives. You’re now re-calculating, re-filing, and facing penalties.

Why this happens: If your payroll system doesn’t auto-sync with compliance laws, someone has to manually track updates—and that’s a ticking time bomb.

4. The Missed Deadline Domino Effect

It was a holiday on the 30th, but you didn’t adjust your payroll cycle. Funds were released late, salaries got delayed. No matter the excuse, employees notice.

Why this happens: HR and finance teams juggle many tasks. Without calendar-aware automation, things fall through—even if intentions were good.

5. LOP Gone Wrong

A team member took 5 unpaid leaves, but only 2 were recorded. They received a higher salary, and the correction will now show up in next month’s payslip—creating confusion and frustration.

Why this happens: Leave management and payroll often live in separate systems. And when they’re not integrated, discrepancies are inevitable.

6. Systems That Don’t Talk to Each Other

Your attendance is tracked in a biometric device. Expenses in a different app. Payroll in Excel. All managed by different people. Each month, data needs to be compiled, reconciled, and cross-checked—but sometimes it isn’t.

Why this happens: Using multiple, disconnected systems is like assembling a puzzle with mismatched pieces. It’s hard to see the full picture—and easy to miss a detail.

Why Payroll Errors Hurt More Than You Think

A Small Payroll Mistake Doesn’t Stay Small

A small misstep—like entering wrong leave days—can snowball. HR spends hours fixing a deduction error, re-running payroll, and explaining it to the employee.

What should’ve taken minutes now takes hours—and damages employee trust in the system.

💬 “I wasn’t paid correctly. Can I really trust my payslip next time?”

One bad experience lingers. Employees begin doubting every payslip. HR becomes reactive—resolving complaints instead of focusing on strategic HR.

And that trust? It’s not easy to win back.

🔁 Multiply That by 10… or 100

- One misclassified contractor becomes ten

- A miscalculated tax slab affects hundreds

- A salary delay hits company-wide morale

When errors scale, so does the damage.

Hidden Cost 1: Lost Time

Payroll corrections don’t just waste HR’s time—they slow down managers, finance, and employees. And it’s never planned time.

Studies show 20–30% of HR time goes into resolving payroll issues in small-to-mid-sized businesses.

Hidden Cost 2: Compliance Penalties

Statutory bodies won’t accept “we made a mistake.” Delays in PF or TDS filings can:

- Trigger financial penalties

- Cause loss of government incentives

- Damage your brand’s reputation

- Raise red flags during audits

Hidden Cost 3: Employee Dissatisfaction

Late or incorrect payments frustrate employees. Over time, they lose faith in the company’s systems.

- Morale and productivity take a hit

- Top talent becomes hard to retain

- Workplace rumors and distrust spread fast

A smooth payroll says, “We value you.”

Errors say, “You’re just a number.”

The Real Cost? A Business That’s Always on the Back Foot

Every payroll mistake turns your HR into a fix-it desk instead of a strategic function. Leadership attention shifts from scaling growth to reviewing tax and compliance.

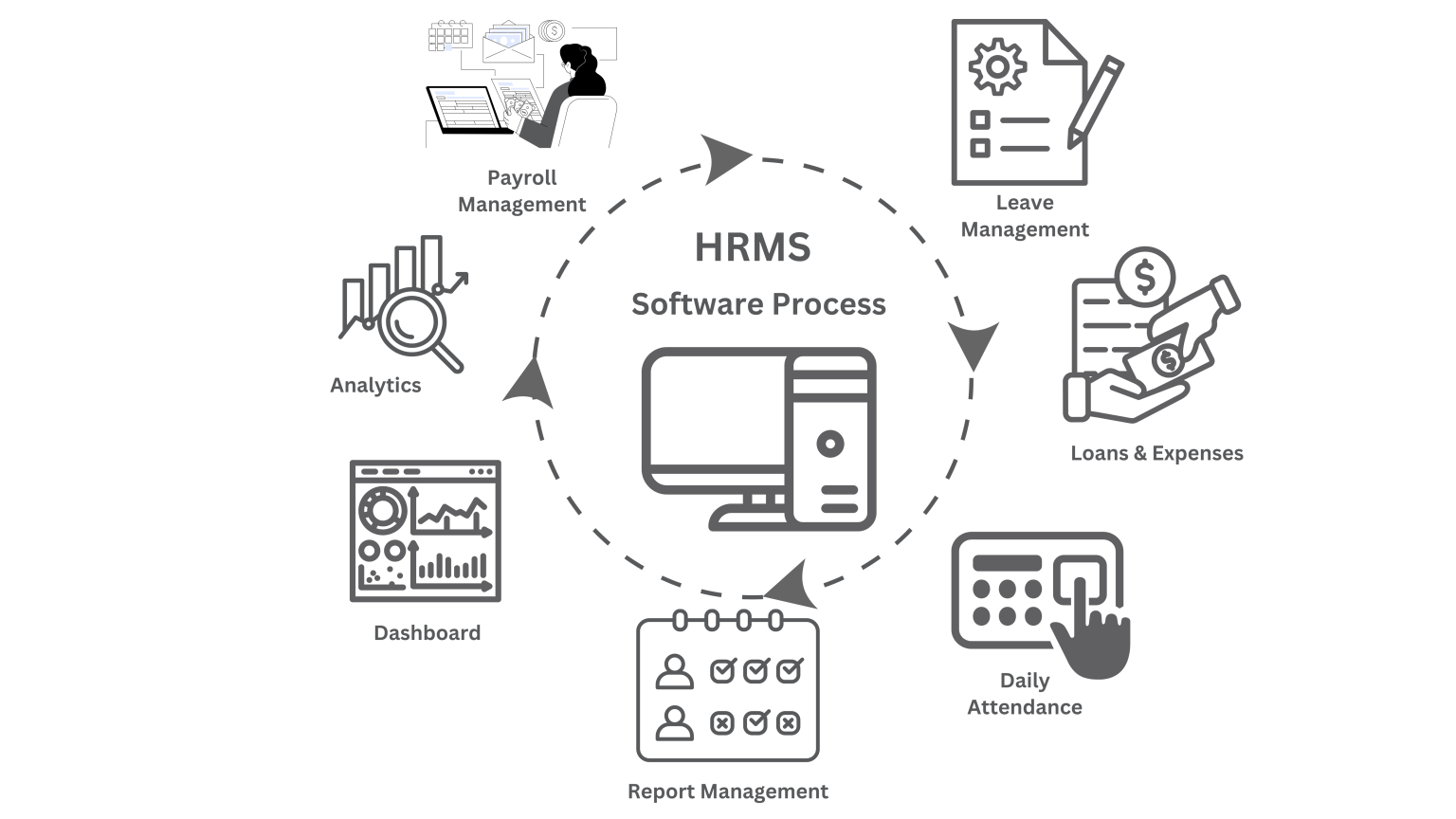

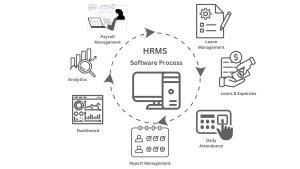

Smart Ways to Avoid Payroll Errors (With Udyamo)

- Let Automation Take Over the Chaos: From attendance to taxes—everything’s processed without human intervention.

- Link Attendance, Leave & Payroll in Real-Time: Every leave or holiday syncs with payroll. No disputes.

- Stay Ahead of Compliance: TDS, ESI, PF, PT—Udyamo auto-adjusts with every law change. Built-in reports ready at a click.

- Catch Errors Before Payroll Runs: Alerts for missing PANs, invalid earnings, incomplete records—no last-minute surprises.

- Use Smart Approval Workflows: Manager → HR → Finance. Everyone’s accountable, nothing missed.

- Empower Employees to Help Themselves: Payslips, tax declarations, queries—self-service keeps teams happy and HR free.

- Roll Back Errors in One Click: Fix an issue for one person—without disrupting everyone’s payroll.

Bonus Edge: Audit-Ready, Always

Every change, every transaction—logged. Whether internal review or government audit, Udyamo has you covered.

Final Thoughts: Don’t Let Payroll Errors Define Your HR

Each error costs more than just money—it costs time, trust, and focus. But with Udyamo, payroll becomes one less thing to worry about.

Ready to Experience Error-Free Payroll?

MS TEAMS APPS

MS TEAMS APPS

MS TEAMS APPS

MS TEAMS APPS